Disclaimer: All information presented is for research purposes & not financial advice. All opinions posted are my own. At the time of writing, I own shares & calls of $RCAT.

Other Articles in Series

Red Cat Holdings: Company Profile

Red Cat Holdings: The Next Prime Contractor (Bull Thesis)

Summary

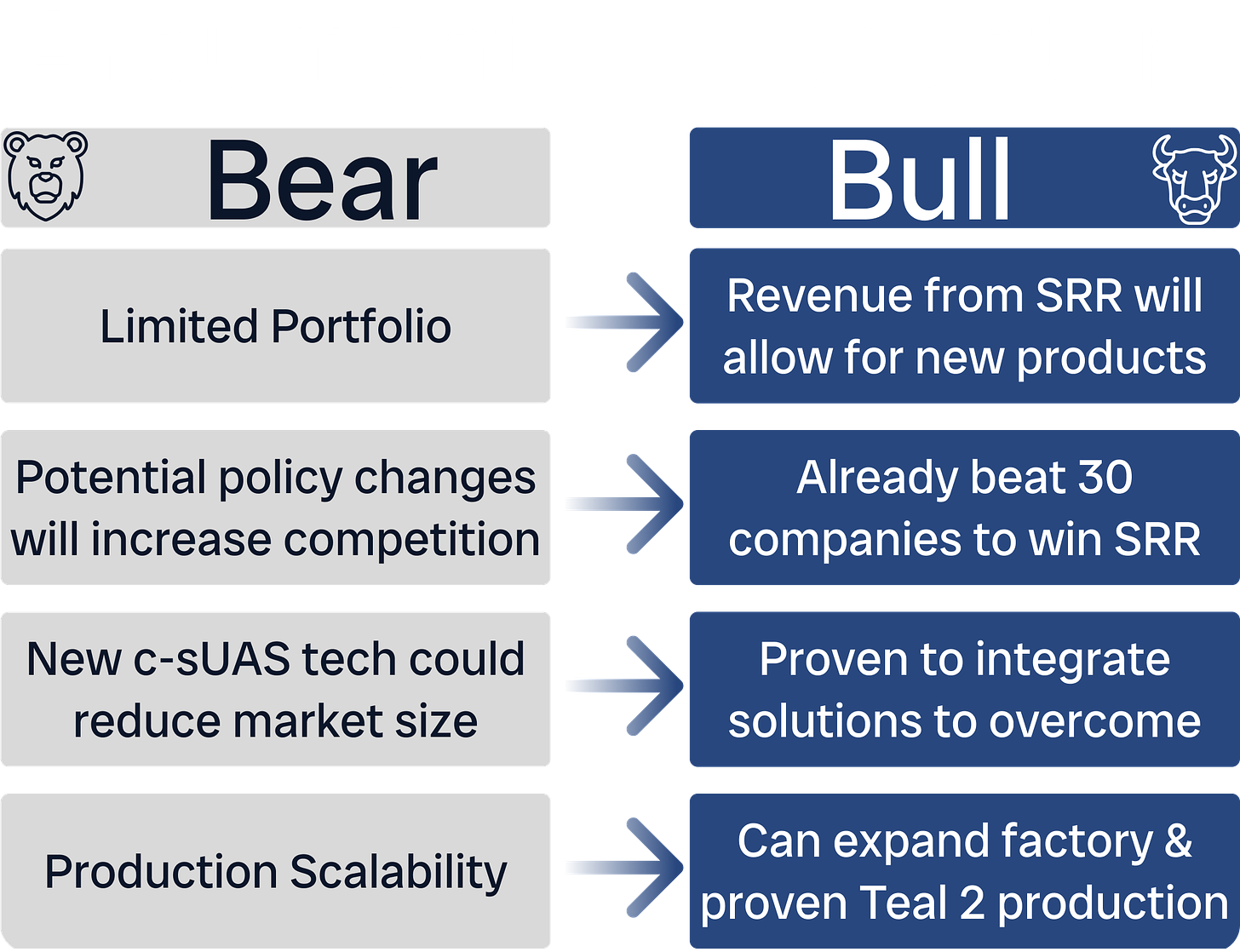

Limited Product Portfolio

Red Cat Holdings currently only has two products (Black Widow & Edge130) and a limited customer base.

Both products exist within the same small unmanned aerial systems (sUAS) space, and, despite recent contract wins, exposes the company to risk should the market conditions of sUAS change in the future.

As a defense focused company, most of their revenue comes from militaries and the US Border Patrol.

Lacking diversity in both products & customers opens Red Cat to risk should either markets experience any disruptions

DoD Acquisition Policy

Currently, there is a focus on changing Department of Defense (DoD) acquisition policy in the public discourse. These changes focus on allowing the DoD to move on from long term programs and reducing regulations that slow down the process.

These changes, if implemented, would reduce the moat provided by the Short Range Reconnaissance (SRR) program of record (POR) won by Red Cat in November 2024. Meaning, if another company produces a competitive sUAS drone, the DoD would be able to quickly pivot from Red Cat’s Black Widow and into the new system.

Counter sUAS Technology

The sUAS industry since the Ukranian war has been a game of cat & mouse between drone technology & counter technology. This industry is rapidly evolving with new technologies seemingly everyday.

Should the Black Widow be outmatched either by kinetic systems or electronic warfare (EW) systems, the Army may look to move on or decrease their adoption of the Black Widow.

This threat will not completely eliminate the use-cases for the Black Widow, but would decrease their addressable market share.

Operational Challenges

Red Cat has yet to prove they can scale their production levels to the levels needed by the US Army. While there is no proof they are unable to, an inability to effectively scale and do so profitability could severely limit their path to profitability & the trust the Army has in their ability to satisfy the scale of their needs.

Counter Arguments

Limited Product Portfolio

Red Cat’s grip on the near-term (1-3 years) market is secured by current acquisition policy. As part of the SRR POR they should achieve profitability in FY2025, the reinvestment of this capital should allow Red Cat to acquire or develop new technologies.

Red Cat has proven savvy in their acquisition of company’s (Teal / Flightwave) and should be trusted to do it again.

They are currently in development of two new systems FANG / Trichon. They should continue to develop & improve systems to match the evolving market.

DoD Acquisition Policy

There has been no change to the acquisition policy. Should any changes occur that increase the competitive landscape of the industry, Red Cat should be a considered favorite to steal market share from others and not have their own market share diminished.

Red Cat secured the SRR POR by out performing 30 other companies and beat out the incumbent of the previous program of record for SRR.

Acquisition policy changes should be a tailwind for Red Cat due to their track record of success in competitive programs.

Counter sUAS Technology

Red Cat has proven to overcome previous advancements in EW through a partnership with Doodle Labs [source]. By developing a modular platform in the Black Widow, further advancements in c-sUAS could be overcome by improvements to the current platform.

Drones place in the future warfare has crossed the Rubicon. c-sUAS technology will not be able to eliminate or diminish their role in the near term.

Operational Challenges

Teal’s Salt Lake facility has the capacity to expand and they already started hiring to satisfy the anticipated demand in late July. Scaling production is hard, but the team has been making all the right moves to quickly scale.

In terms of profitability, Red Cat posted a 31% gross margin in Q2 2023. This should increase as they produce to scale and fully utilize all the shifts in their factories. The team has a goal of a ~45% gross margin, but could reach profitability at a 30% gross margin with the anticipated revenue in 2025. (Note: current guidance does not factor in SRR, anticipated revenue should be ~$100-$120M w/ guidance & SRR)

Supporting Evidence

DoD Acquisition Policy

Recent Changes

The current administration has prioritized “acquisition at speed” and presented a number of improvements to many acquisition pathways [source]. Douglas R. Bush has touted how they cut the time to acquire systems from 7-10 years, down to 4-6 years. [source]

Many sources say this is still far too slow and we are far too reliant on legacy systems. China is reported to have acquired the J-20 stealth fighter in half the time as the US acquired F-35’s, their largest shipyard has more capacity than the whole of the US, and they fielded hypersonic missiles well before the US. [complete report on US vs China defense industrial base]

As evidence of the speed the US should move at, the Replicator initiative set the goal to field new systems in 18-24 months [source] This raises the question how the next administration could continue the reforms to DoD acquisition to better match the speed needed.

Future Administration

Let’s examine the next administration’s comments & plans towards military acquisition. Elon Musk has stated a desire to move on from the F-35 in favor of unmanned systems [source] This seems counter intuitive for a bear thesis, but the policy & precedent a move like this would make could end up proving to be detrimental to Red Cat.

Turning attention to Project 2025’s comments on DoD acquisition. There are a couple proposals that could ring alarm bells for Red Cat. Project 2025 Reforms (Page 95-96)

Authority for DoD to move on from program specific “stove pipes” that may no longer be relevant or are underperforming

Allow service secretaries to conduct “Night Court” to terminate outdate or underperforming programs

Reallocate funds & fast track programs that better meet pressing needs & will work.

Historically, the US Army has continued to invest in improving programs of record. This patience & development allows companies to be insulated from competition.

Takeaway

If some form of the acquisition policies area enacted, Red Cats grip on the market is contingent on continued performance. Should a competitor introduce a system that performs better, we could see Red Cat lose foothold in the market that would historically be secure with a program of record.

Realistically, this is not a scenario that would playout in the next year as the Black Widow is the best SRR drone available for the Army.

Counter sUAS Technology

The Black Widow has emerged at the top of its class in terms of SRR performance. However, not long ago the previous program of record, Skydio’s X2D, performed poorly in Ukraine [source]. This poor performance among others should have been a contributing factor in them losing their program of record.

The industry as a whole is relatively young and advancements are rapidly progressing. We are seeing large investments in the c-sUAS space by nearly all militaries across the globe. In a game of cat & mouse, it feels inevitable that c-sUAS will gain an upper hand and the technologies used by Black Widow today may not be effective tomorrow.

As outlined in the DoD acquisition policy, degradation of the Black Widow’s performance may not be tolerable by the DoD in the long run. To stay relevant, Red Cat will continue to invest in the R&D required to overcome new technologies.

In a concerning statement at Red Cat’s townhall on Nov. 19th 2024, Jeff Thompson CEO stated “Well, the R&D budget is not going to go crazy just because we won SRR. So, I'm coming down on the Scrooge side of that, we've done basically five years of R&D.”[source] Complacency in the area of improving their limited product portfolio presents a great risk to their long term foothold in the industry.