Red Cat Holdings: Q2 2024 Earnings Expectations

Disclaimer: All information presented is for research purposes & is not financial advice. All opinions posted are my own. At the time of writing, I own shares & calls of $RCAT.

Date of Call

December 15th — Jeff in an Alpha Wolf interview said earnings would be on this date. Given that is a Sunday, it might have been a misspeak.

Fiscal Year Change

Red Cat Holdings (RCAT) is shifting fiscal calendars at the start of the next year to a calendar-year fiscal year. The current earnings should be the last under the old fiscal calendar.

Old: May 1st - April 30th

New: January 1st - December 31st (Starting in 2025)

What to Expect

Those feeling the current momentum of Red Cat Holdings should set realistic expectations going into the next earnings call.

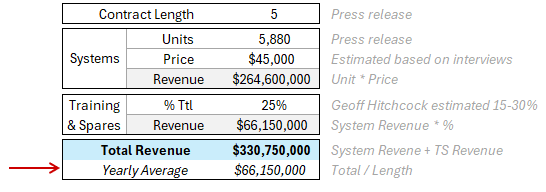

All eyes should be fixed on the future guidance & execution strategy of Red Cat Holdings. The team secured an estimated ~$300M contract (SRR) in November, but that contract should not be expected to result in strong financial results until mid-2025. The team may not provide updated guidance during the upcoming earnings, but it should be a top focus of investors nonetheless.

Additionally, there are a number of anticipated catalysts expected in the near-term. The leadership team has communicated excitement on a number of contracts that could be announced soon. They have also teased new partnerships that could be revealed. Key updates as to their status & timing should be top of mind going into this call.

In the interim, the team has been focused on retooling the factory & building the requisite abilities to scale their production to meet the needs of the SRR contract. Consequentially, financial results from the previous quarter will be soft.

Guidance

Short Range Reconnaissance Financials

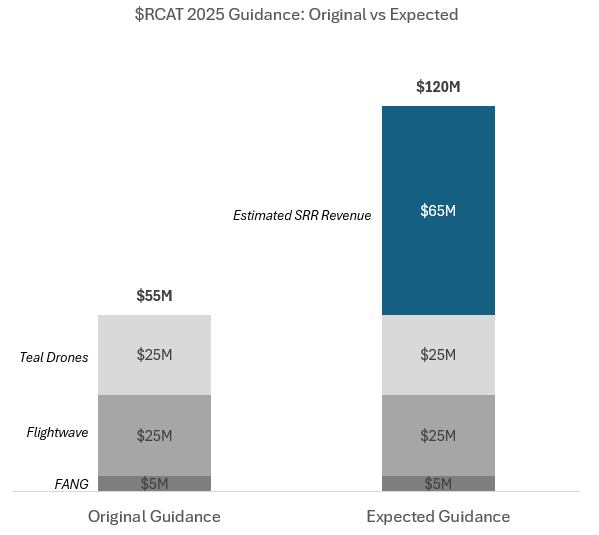

$100-$120M Guidance

If you add the yearly average of SRR to the original $55M guidance, you get to $120M.

However, there is uncertainty in regards to how much of the original $25M for Teal could be cannibalized by SRR.

There is also some uncertainty in terms of the structure of the SRR contract. Is it a flat delivery per year? How high does training, spares, and repairs come in?

Given the uncertainties, I think it is prudent to adjust guidance expectations to a range between $100M and $120M.

Key Updates

As discussed in other articles, there are a number of follow-on orders that have been communicated & should be expected as part of earning a program of record. The CEO of Red Cat, Jeff Thompson, has hinted at those follow on orders being announced soon.

It may be unrealistic to expect an announcement during the earnings. Investors should still expect to hear an update on pending contracts in the pipeline as well as clarity on the timing & status of the contracts that have been anticipated.

Anticipated Contracts

Australian Edge 130 Contract

NATO Contract

Other allied country orders

Follow-on orders from USN/USAF/USMC/Replicator

Moreover, there has been a number of partnerships hinted at. In a couple of interviews, Jeff Thompson has dropped reference to Palantir in context of these partnerships.

Future Strategy / Timeline

Last week, George Matus (CTO of RCAT) announced his departure from Red Cat to pursue new opportunities. This sparked a flurry of questions regarding the future strategy of Red Cat. The full picture of his departure will take time to play out; often decisions like these are not made in a vacuum.

This earnings call gives Jeff time to layout the plans for the future as well as how they plan to execute to meet the production demands of the SRR contract. As mentioned, the Teal factory is undergoing retooling to produce the SRR drone. Updates on the progress and additional steps to improve manufacturing will be key to instill investor confidence in their ability to execute.

I would expect Jeff to focus on the future during this call. Listening to how the team plans to execute & lay out their strategy for the future will be paramount to overcome the soft financials expected.

Financials

Revenue / Income

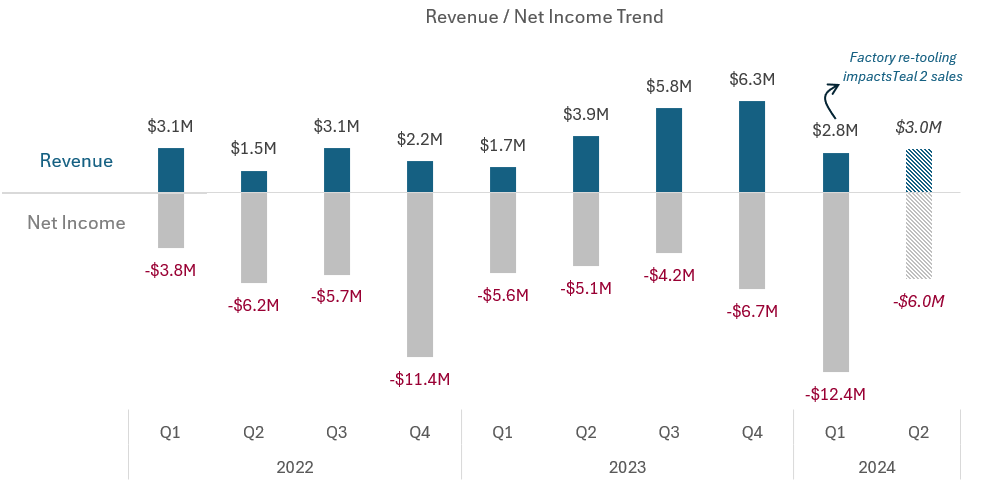

Revenues in Q2 should be expected to be soft and net income should be negative.

Historically, 2023 was the year we saw the Teal 2 start to ramp up in sales. Once the factory went into retooling mode for the Black Widow, revenue dropped in Q1.

There is an off-chance the Edge 130 could surprise in revenue for Q2. This will be the first earnings with a full quarter of Edge 130 sales in the financials, this should be an area to keep an eye on.

Likewise, this will also be the first full quarter with Flightwave’s expenses in the financials, so there may be a surprise in net income as well.

Overall, there should not be much stock put on the revenue or net income financials this quarter. Guidance & forward looking statements should be the focus.

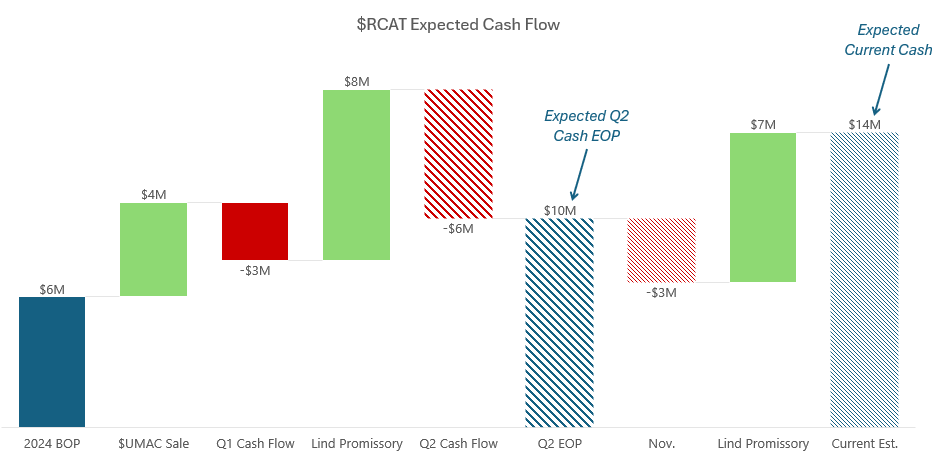

Cash Position / Cash Flow

Cash flow & cash positions are where the attention should be at for the upcoming earnings.

It is expected that RCAT will receive a ~20% upfront SRR payment in early 2025, as well as, potential funding through the Office of Strategic Capital (OSC). RCAT is not expected to post positive cash flow before these payments. It will be imperative to understand how RCAT will fund operations while they await those payments.

Investors should be aware that the cash position in the current earnings will be understated by ~$7M. In late November, they secured an additional promissory note from Lind Capital. This should give them ~$14M cash on hand to start December 2024.